The banking, financial services, and insurance (BFSI) sector demands robust software testing practices to ensure security, reliability, and regulatory compliance. At ideyaLabs, we specialize in comprehensive BFSI testing services that help financial institutions deliver flawless digital experiences to their customers.

Understanding BFSI Software Testing

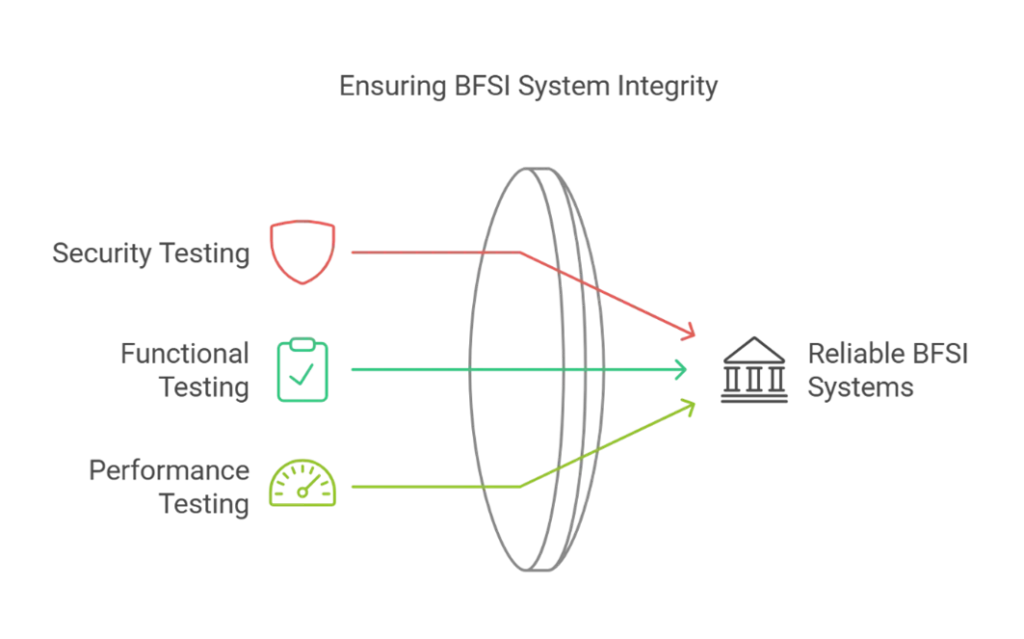

BFSI software testing encompasses the systematic validation of applications used in banking, financial services, and insurance sectors. This specialized testing ensures that financial applications meet stringent security requirements, regulatory compliance, and deliver accurate functionality for handling sensitive financial transactions.

Key Components of BFSI Testing Services

1. Security Testing

- Authentication and authorization validation

- Data encryption verification

- Penetration testing

- Vulnerability assessments

- Compliance with security standards

2. Functional Testing

- Account management validation

- Transaction processing verification

- Payment gateway integration testing

- Interest calculation accuracy

- Statement generation testing

3. Performance Testing

- Load testing for concurrent users

- Stress testing during peak transactions

- Response time optimization

- Scalability testing

- System stability verification

Critical Challenges in BFSI Testing

Complex Integration Requirements

- Multiple third-party system integrations

- Legacy system compatibility

- Real-time data synchronization

Regulatory Compliance

- Region-specific regulations

- KYC/AML compliance

- Data privacy requirements

- Financial reporting standards

Security Concerns

- Cyber threat protection

- Data breach prevention

- Fraud detection capabilities

Best Practices for BFSI Software Testing

Automated Testing Implementation

- Continuous integration/deployment

- Regression testing automation

- Performance monitoring

- Test case management

Comprehensive Test Coverage

- End-to-end testing scenarios

- Cross-browser compatibility

- Mobile application testing

- API testing

Quality Assurance Process

- Structured test methodology

- Regular security audits

- Compliance verification

- Performance benchmarking

Benefits of Professional BFSI Testing Services

Working with ideyaLabs for your BFSI testing needs offers:

- Reduced time-to-market

- Enhanced security measures

- Improved customer satisfaction

- Regulatory compliance assurance

- Cost-effective quality assurance

Conclusion

Effective BFSI software testing is crucial for maintaining the integrity and reliability of financial applications. Partner with ideyaLabs for comprehensive BFSI testing services that ensure your applications meet the highest standards of quality, security, and compliance.

FAQs

What is BFSI software testing?

BFSI software testing is a specialized quality assurance process for banking, financial services, and insurance applications that ensures security, functionality, and regulatory compliance.

Why is BFSI testing important?

BFSI testing is crucial because it helps prevent financial losses, ensures data security, maintains regulatory compliance, and protects customer interests in financial transactions.

What are the key components of BFSI testing services?

Key components include security testing, functional testing, performance testing, integration testing, and compliance testing for financial applications.

How does automated testing benefit BFSI applications?

Automated testing in BFSI applications ensures consistent quality, faster deployment, reduced human error, and comprehensive test coverage across all critical functionalities.

CTA

Ready to enhance your financial application’s quality and security? Contact ideyaLabs today for expert BFSI testing services that ensure your applications meet the highest industry standards.